The Vital Process of Spending Off Coast for Financial Development

Spending offshore can be a strategic relocation for financial growth. It needs careful preparation and a clear understanding of one's monetary objectives and risk cravings. Financiers must examine numerous markets and financial investment methods while taking into consideration lawful implications. A well-crafted strategy that stresses diversification is important. Nonetheless, the complexities entailed can usually be challenging. What steps should one require to browse this elaborate landscape properly?

Comprehending the Perks of Offshore Investing

The attraction of offshore investing hinges on its possibility for financial development and diversity. Capitalists commonly seek chances beyond their residential markets, where they can access a wider variety of assets and investment techniques. Offshore accounts usually supply benefits such as tax obligation effectiveness, permitting individuals to maximize their general tax obligation. Additionally, many overseas jurisdictions offer a secure political and financial atmosphere, which can lower risk exposure.Investing offshore likewise enables individuals to hedge versus money fluctuations and inflation in their home nation. This geographical diversification can improve portfolio resilience during market downturns. Furthermore, overseas investments frequently include access to special funds and investment lorries that may not be offered locally. Overall, the advantages of offshore investing prolong beyond simple capital gains, offering critical benefits that appeal to both skilled and amateur investors aiming to expand their perspectives.

Evaluating Your Monetary Goals and Risk Tolerance

Offshore investing presents various chances, yet success rest on a clear understanding of specific monetary goals and risk resistance. Investors need to first articulate their goals, whether they intend for funding preservation, wealth buildup, or earnings generation. Each goal requires a different investment method and timeline.Next, evaluating danger tolerance is necessary. This involves identifying just how much volatility an investor can hold up against and their emotional reaction to market fluctuations. A comprehensive threat analysis considers factors such as age, economic circumstance, and investment experience.

Looking Into Potential Offshore Markets and Financial Investment Options

Exactly how can investors successfully determine the most promising overseas markets and investment choices? Comprehensive market evaluation is important. Capitalists ought to examine economic stability, growth possibility, and historical performance of various regions. Secret indications such as GDP growth rates, rising cost of living, and unemployment statistics supply understanding into market viability.Next, understanding local sectors can reveal lucrative opportunities. Financiers ought to concentrate on sectors experiencing growth, such as technology, renewable resource, or actual estate. Connecting with monetary advisors and regional experts can likewise generate important details about emerging fads and risks.Additionally, contrasting financial investment cars, such as shared funds, property, or stocks, assists in picking the appropriate alternatives. Investors must examine the liquidity and expected returns of each choice. By carrying out comprehensive research study, investors can purposefully place themselves within promising overseas markets, straightening their investment techniques with potential economic development.

Browsing Legal and Regulative Factors to consider

Capitalists going for success in offshore markets must likewise be mindful of the regulative and lawful frameworks that control these regions - Investing Off Shore. Each territory comes with its very own collection of regulations concerning tax, reporting, and investment limitations, which can significantly affect success and compliance. Understanding these guidelines is essential for ensuring and avoiding lawful risks that financial investments are made based on regional laws.Moreover, capitalists must know anti-money laundering steps and understand your consumer (KYC) requirements, which vary by country. Involving with neighborhood lawful and monetary experts can provide very useful advice, assisting to navigate intricate regulative landscapes. Furthermore, staying educated concerning any type of changes Recommended Site in legislation is crucial, as regulations can progress, impacting investment techniques. Ultimately, detailed research study and legal assessment are crucial for safeguarding a successful overseas investment, guarding both properties and compliance with worldwide laws

Establishing an Effective Financial Investment Technique and Monitoring Development

Crafting a robust investment technique is important for attaining long-term financial development in overseas markets. Capitalists should begin by recognizing their economic objectives, danger tolerance, and investment horizon. This structure permits the option of proper possession courses, such as supplies, bonds, or actual estate, customized to the capitalist's special situations. Diversification plays a vital function in mitigating threats while improving prospective returns.Regularly keeping track of the efficiency of investments is just as important. Investors need to establish up an organized testimonial procedure, reviewing portfolio efficiency against standards and changing approaches as needed. Making use of innovation, such as financial investment tracking software, can facilitate this oversight and give important insights into market trends.Additionally, staying educated regarding geopolitical events and economic changes in overseas markets is critical for prompt decision-making. By preserving a disciplined approach and adapting techniques as conditions evolve, financiers can maximize their chances for economic growth.

Frequently Asked Inquiries

Exactly How Much Cash Do I Need to Begin Offshore Investing?

Determining the amount needed to start overseas investing varies significantly based on specific goals, investment types, you can check here and jurisdictions. Usually, investors must think about a minimum of $5,000 to $10,000 to successfully participate in overseas possibilities.

Can I Open an Offshore Account From Another Location?

Opening up an overseas account from another location is feasible, depending upon the financial institution's plans. Usually, clients can finish the necessary documentation online, yet verification procedures might call for additional documentation to guarantee conformity with regulations.

What Are the Tax Ramifications of Offshore Spending?

Tax ramifications of overseas investing vary by territory, commonly including complex regulations - Investing Off Shore. Capitalists may encounter reporting needs, potential tax on foreign income, and the requirement to abide by both global and neighborhood tax legislations to avoid fines

Exactly how Do I Pick a Reputable Offshore Investment Advisor?

Selecting a trustworthy overseas investment expert involves investigating qualifications, examining client evaluations, evaluating experience in details markets, and ensuring compliance with guidelines. Credibility and transparency are essential aspects to consider during the option process.

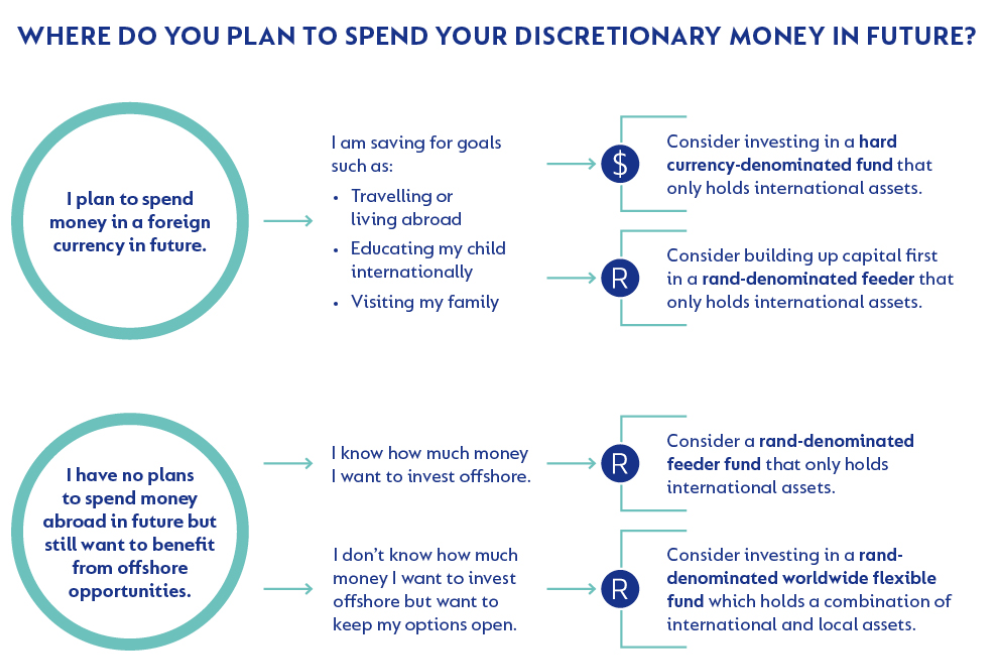

What Currencies Should I Think About for Offshore Investments?

When taking into consideration money for overseas investments, one need to assess stability, historical efficiency, and possibility for growth. Popular options usually include the United States buck, Euro, Swiss franc, and emerging market money, relying on risk tolerance and financial investment goals. Additionally, lots of overseas jurisdictions give a stable political and economic setting, which can minimize danger exposure.Investing offshore additionally allows people to hedge versus currency changes and rising cost of living in their home country. Overseas investments usually consist of accessibility to i loved this unique funds and financial investment cars that may not be available domestically. How can capitalists efficiently recognize the most promising offshore markets and investment choices? Crafting a robust financial investment method is essential for accomplishing long-term monetary development in overseas markets. Using modern technology, such as investment tracking software program, can facilitate this oversight and offer beneficial understandings into market trends.Additionally, staying educated concerning geopolitical occasions and financial changes in overseas markets is essential for prompt decision-making.